This use of company automobiles by employees is not a qualified business use. John Maple is the sole proprietor of a plumbing contracting business. As part of Richard’s pay, Richard is allowed to use one of the company automobiles for personal use. The company includes the value of the personal use of the automobile in Richard’s gross income and properly withholds tax on it.

If you construct, build, or otherwise produce property for use in your business, you may have to use the uniform capitalization rules to determine the basis of your property. For information about the uniform capitalization rules, see Pub. 551 and the regulations under section 263A of the Internal Revenue Code.

Definition of Depreciable Asset

The total cost you can deduct each year after you apply the dollar limit is limited to the taxable income from the active conduct of any trade or business during the year. Generally, you are considered to actively conduct a trade or business if you meaningfully participate in the management or operations of the trade or business. To qualify for the section 179 deduction, your property must have been acquired for use in your trade or business. Property you acquire only for the production of income, such as investment property, rental property (if renting property is not your trade or business), and property that produces royalties, does not qualify.

- The IRS provides a class life list of numerous types of property in Publication 946.

- No more running out of asset usage before you’re ready to replace them.

- For 15-year property depreciated using the 150% declining balance method, divide 1.50 (150%) by 15 to get 0.10, or a 10% declining balance rate.

- The double declining balance method is often used for equipment when the units of production method is not used.

- Go to TaxpayerAdvocate.IRS.gov to help you understand what these rights mean to you and how they apply.

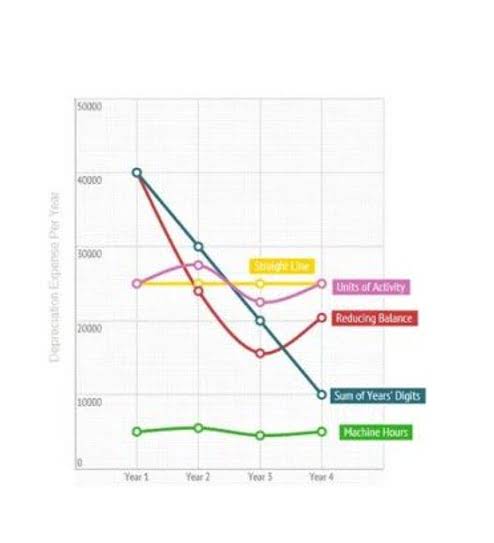

- Companies depreciate assets for both tax and accounting purposes and have several different methods to choose from.

- An employer who allows an employee to use the employer’s property for personal purposes and charges the employee for the use is not regularly engaged in the business of leasing the property used by the employee.

You reduce the adjusted basis ($173) by the depreciation claimed in the fifth year ($115) to get the reduced adjusted basis of $58. There is less than 1 year remaining in the recovery period, so the SL depreciation rate for the sixth year is 100%. You multiply the reduced adjusted basis ($58) by 100% to arrive at the depreciation deduction for the sixth year ($58).

How Do You Calculate Depreciable Assets?

The depreciation method for this property is the 200% declining balance method. The corporation must apply the mid-quarter convention because the property was the only item placed in service that year and it was placed in service in the last 3 months of the tax year. On December 2, 2019, you placed in service an item of 5-year property costing $10,000. You did not claim a section 179 deduction and the property does not qualify for a special depreciation allowance. You used the mid-quarter convention because this was the only item of business property you placed in service in 2019 and it was placed in service during the last 3 months of your tax year.

I made the following infographic to give you some examples of depreciable assets in a small business. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. If you choose the straight-line method to depreciate an asset, you cannot switch to MACRS later. However, you may use a different method for additional assets acquired in subsequent years.

What Qualifies as a Depreciable Asset?

The following is a list of the nine property classifications under GDS and examples of the types of property included in each class. These property classes are also listed under column (a) in Section B of Part III of Form 4562. For detailed information on property classes, see Appendix B, Table of Class Lives and Recovery Periods, in this publication.

Guide to doing business in Canada: Mergers & acquisitions – Lexology

Guide to doing business in Canada: Mergers & acquisitions.

Posted: Fri, 20 Oct 2023 07:00:00 GMT [source]

On July 1, 2022, you placed in service in your business qualified property that cost $450,000 and that you acquired after September 27, 2017. You deduct 100% of the cost ($450,000) as a special depreciation allowance for 2022. You have no remaining cost to figure a regular MACRS depreciation deduction https://www.bookstime.com/articles/internal-control-in-accounting for your property for 2022 and later years. In January 2020, Paul Lamb, a calendar year taxpayer, bought and placed in service section 179 property costing $10,000. Paul elected a $5,000 section 179 deduction for the property and also elected not to claim a special depreciation allowance.

The basis of real property also includes certain fees and charges you pay in addition to the purchase price. These are generally shown on your settlement statement and include the following. You can choose to use the income forecast method instead of the straight line method to depreciate the following depreciable intangibles. Computer software is generally a section 197 intangible and cannot be depreciated if you acquired it in connection with the acquisition of assets constituting a business or a substantial part of a business. You may not be able to use MACRS for property you acquired and placed in service after 1986 if any of the situations described below apply.

See Rent-to-own dealer under Which Property Class Applies Under GDS? You made a down payment to purchase rental property and assumed the previous owner’s mortgage. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Let’s say you’re trying to calculate the depreciation of your server software. The estimated scrap value is $10,000 and the life span is 10 years.

Then, you would divide that by 10 to get $4,000 of depreciation per year using this method. Trying to depreciate all of your assets may not be the smartest decision. Short term assets that don’t stay in your business long shouldn’t be depreciated. Assets with lower value also may not need to go through the process, though they should still be tracked.

I made the following infographic to explain to you the different types of non-depreciable assets in the context of a small vegetable farm. However, a business cannot depreciate an asset that it does not effectively own. For instance, if an airline hires an aircraft temporarily in anticipation of a busy season, it should not be considered as a depreciable property of the airline. depreciable assets are expected to last at least 12 months in the business from when they are acquired. If you’re confused about whether you should depreciate an asset or not, look for these five common characteristics of depreciable assets.